Real-world asset (RWA) tokenization has emerged as one of the most promising trends in the decentralized finance ecosystem. With 260% growth in the first half of 2025, reaching a market capitalization of $23 billion, RWAs are redefining how we interact with traditional assets.

What are Tokenized Real-World Assets?

Tokenized RWAs represent physical or traditional financial assets that have been converted into digital tokens on a blockchain. This includes everything from real estate and artwork to treasury bonds and commodities. Tokenization enables fractional ownership, increasing liquidity and democratizing access to investments traditionally reserved for institutional investors.

Benefits of RWA Tokenization

Tokenization offers multiple benefits for both investors and asset owners:

- Enhanced liquidity: Traditionally illiquid assets can be traded 24/7

- Accessibility: Lower minimum investments enable broader participation

- Transparency: Immutable blockchain record of all transactions

- Efficiency: Reduced intermediaries and transaction costs

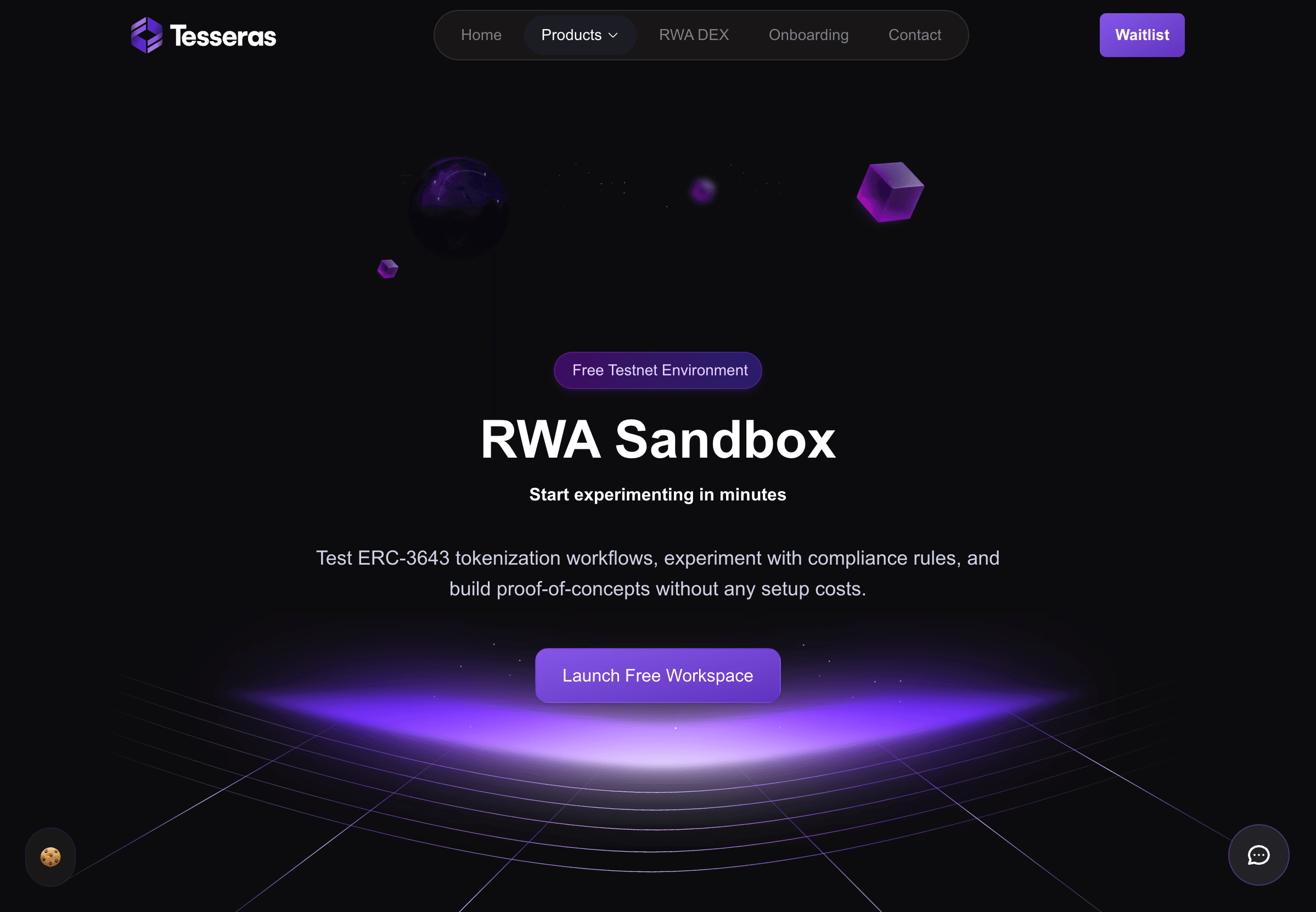

As we advance toward 2025, we expect to see massive adoption of RWAs in established DeFi protocols, with projects like Tesseras leading innovation in this space through solutions that combine regulatory compliance with DeFi flexibility.

Stay Updated on RWA Trends

Get the latest insights on real-world asset tokenization, DeFi innovations, and market trends delivered to your inbox.